Submitted by Tyler Durden on

01/08/2013 08:18 -0500

From GoldCore

China's Gold Volume “Shot Through The Roof” Yesterday Ahead Of Lunar New Year

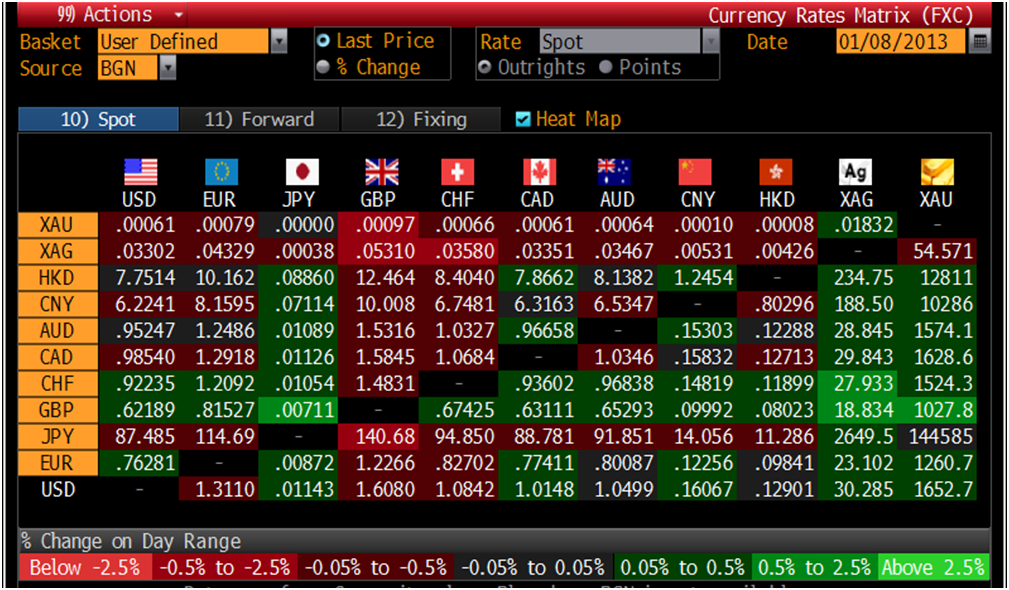

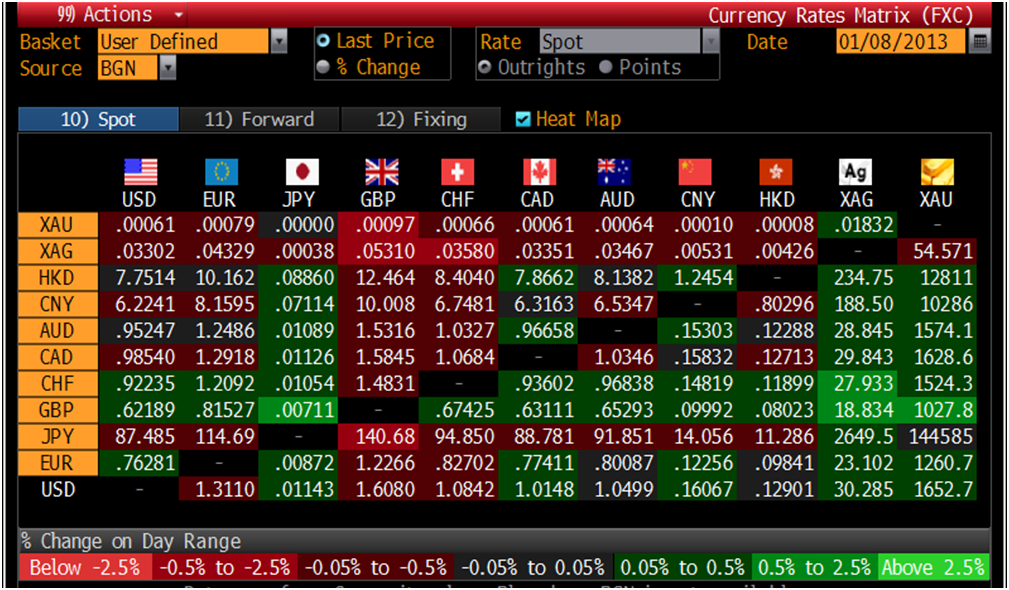

Cross Currency Table – (Bloomberg)

Gold 'Lures' Japan's Pension Funds, Govt Targets Inflation – Business Week

Be very sceptical of your fund manager's priorities – The Irish Times

COMMENTARY

Sterling crisis looms as UK current account deficit balloons – The Telegraph

Japan May Or May Not Mint Quadrillion Yen Coins, But It Will Monetize European Debt – Zero Hedge

US Mint Bullion Coin Sales – GoldSeek

Russell: The 60-Year Shocker, Silver Shorts & Gold – King World News

China's Gold Volume “Shot Through The Roof” Yesterday Ahead Of Lunar New Year

Today’s AM fix was USD 1,653.75, EUR 1,261.06 and GBP

1,028.07 per ounce.

Yesterday’s AM fix was USD 1,653.75, EUR 1,267.82 and GBP 1,029.60 per ounce.

Yesterday’s AM fix was USD 1,653.75, EUR 1,267.82 and GBP 1,029.60 per ounce.

Silver is trading at $30.38/oz, €23.25/oz and

£18.95/oz. Platinum is trading at $1,569.50/oz, palladium at $672.00/oz and

rhodium at $1,150/oz.

Cross Currency Table – (Bloomberg)

Gold fell $9.90 or 0.6% in New York yesterday and closed at

$1,646.40/oz. Silver slipped to a low of $29.84 and finished with a loss of

0.2%.

Gold’s losses in recent days have been more pronounced in

dollar terms as gold’s price fall in euros, pounds and other fiat currencies has

been far more modest (see charts). Given the challenges facing all currencies in

2013 the price decline is likely another correction prior to further gains.

Gold edged up on Tuesday as the euro held steady on to two

days of gains on hopes that the European Central Bank will not cut interest

rates at a meeting this week.

A Reuter’s poll of economists forecast no rate cut but they

cannot agree on whether there will be further cuts in the next few months due to

a muddled Eurozone economy.

Data showed Eurozone sentiment improved for its 5th month in

a row, based on a drop in Spanish jobless figures and a successful Greek bond

repurchase.

Harmony Gold, South Africa’s 3rd biggest gold producer said

its Kusasalethu mine remains closed and could be shut permanently with the loss

of around 6,000 jobs after managers received death threats and police were shot

at.

Reuters report that Asia's physical market has picked up so

far this year, with buyers tempted by last week's big drop in prices -- when

prices retreated to as low as 1,626 per ounce -- and on demand ahead of the

Lunar New Year, traders said.

The trading volume on the Shanghai Gold Exchange's 99.99 gold

physical contract shot through the roof on Monday, hitting a record of 19,504.8

kilograms, after double-counting transactions in both directions.

"Physical demand is very strong," said a Beijing-based

trader. "It's a combination of the attraction of lower prices as well as

pre-holiday demand."

But such appetite could waver if prices recover towards

$1,700, he added.

U.S. gold gained 0.1 percent to $1,648.60. Shanghai's 99.99

gold traded at 331.58 yuan a gram, or $1,658 an ounce - a $10 premium over spot

prices, compared to single-digit premium most of last year.

Technical analysis suggested that spot gold could edge higher

to $1,665 an ounce, and a previous target of $1,625.79 has been temporarily

aborted, said Reuters market analyst Wang Tao.

Bloomberg quoted Feng Liang, an analyst at GF Futures Co., a

unit of China’s third-biggest listed brokerage who said “the recent price drop

has attracted some purchases, evidenced by the volumes in China,” “Whether this

rebound can be sustained depends on the emergence of physical buyers, especially

from China and India, at a time when demand is meant to be strong.”

In China, demand typically picks up before Christmas and

lasts through the Lunar New Year in February. India’s wedding season, a

peak-consumption period for gold jewelry, runs from November to December and

from late March through early May. The countries are the two biggest bullion

consumers.

Gold

Snaps Three-Day Drop on Signs of Increased Chinese Demand -

ReutersGold 'Lures' Japan's Pension Funds, Govt Targets Inflation – Business Week

Be very sceptical of your fund manager's priorities – The Irish Times

COMMENTARY

Sterling crisis looms as UK current account deficit balloons – The Telegraph

Japan May Or May Not Mint Quadrillion Yen Coins, But It Will Monetize European Debt – Zero Hedge

US Mint Bullion Coin Sales – GoldSeek

Russell: The 60-Year Shocker, Silver Shorts & Gold – King World News

No comments:

Post a Comment